P-CBO Guarantee

Overview

P-CBO* guarantee services enable KODIT to support SMEs and middle-standing companies in procuring funds from direct financial markets by the issuance of corporate bonds. (*P-CBO: Primary collateralized bond obligation)

In the late 1990s following the Asian financial crisis, most companies excluding a handful of high performers experienced difficulty not only in the issuance of new corporate bonds but also loan conversion. As a result, the guarantee for primary collateralized bond obligations (P-CBO) was adopted in 2000 under government guidelines.

KODIT’s P-CBO guarantee system helped stabilize the direct financing market, alleviating capital shortages for SMEs and middle-standing companies. Even after the Asian financial crisis, the system stimulated the corporate bond market and substantially helped companies procure stable and long-term funds.

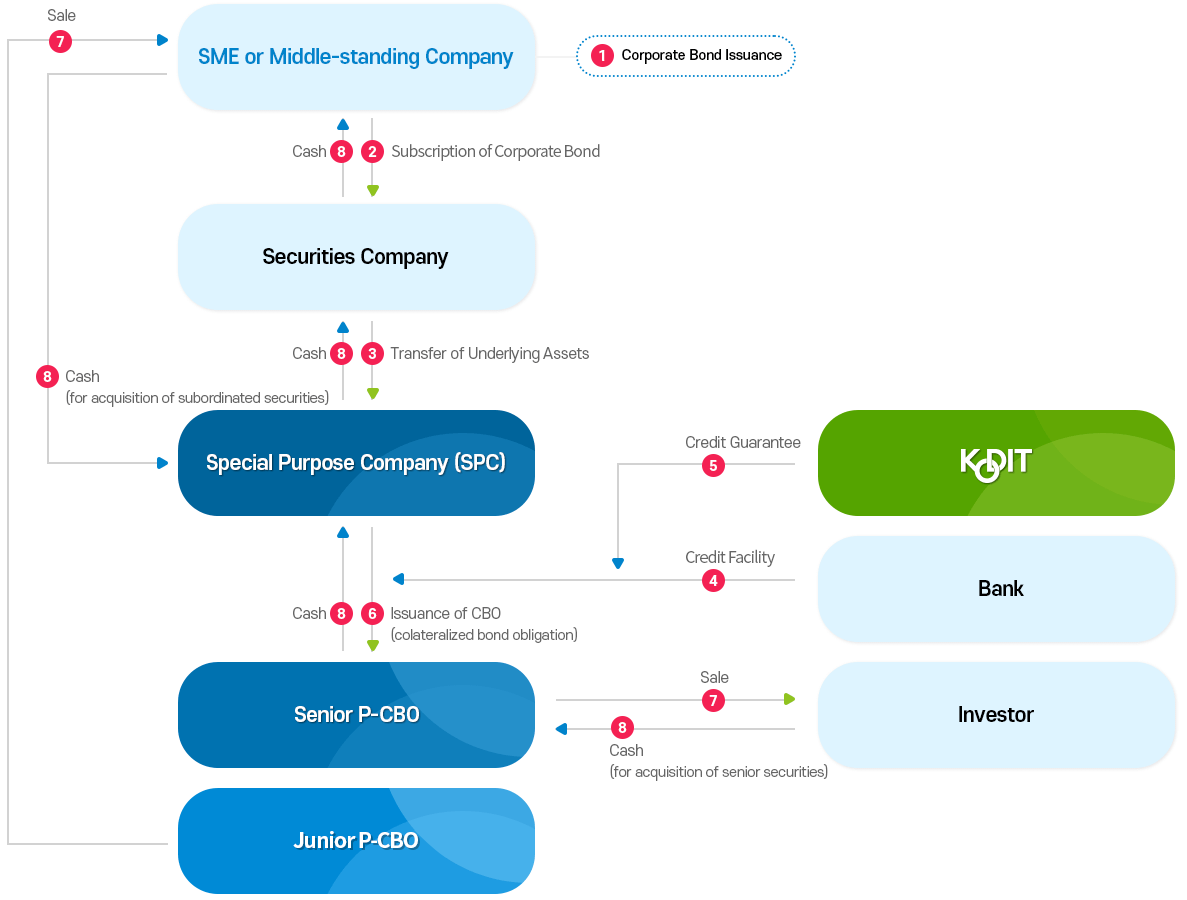

1. Corporate Bond Issuance → SME or Middle-standing Company → 2. Acquisition of Corporate Bond → Securities Company

Securities Company → 3. Transfer of Underlying Assets → Special Purpose Company (SPC)

Bank → 4. Credit Extension, KODIT → 5. Credit Guarantee

Special Purpose Company (SPC) → 6. Issuance of CBO(colateralized bond obligation) → Senior P-CBO

Senior P-CBO → 7. Sale → Investor

Subordinated P-CBO → 7. Sale → SME or Middle-standing Company

Investor → 8. Cash(for acquisition of senior securities) → Senior P-CBO → 8. Cash → Special Purpose Company (SPC) → 8. Cash → Securities Company → 8. Cash → SME or Middle-standing Company → 8. Cash(for acquisition of subordinated securities) → Special Purpose Company (SPC)

Procedure

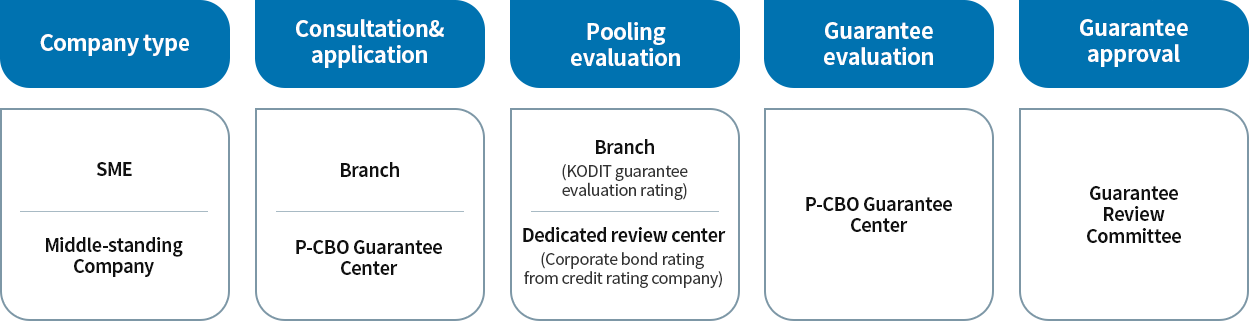

Company type

- SME

- Middle-standing company

Consultation & application

- Branch

- P-CBO Guarantee Center

Pooling evaluation

- Branch(KODIT guarantee evaluation rating)

- Dedicated review center(Corporate bond rating from credit rating company)

Guarantee evaluation

- P-CBO Guarantee Center

Guarantee approval

- Guarantee Review Committee

Operation

Pooling Limits

KODIT limits pooling for P-CBO guarantees. SME assets may be pooled between KRW 3 billion and KRW 25 billion depending on KODIT’s credit rating. Middle-standing companies may pool between KRW 10 billion and KRW 105 billion depending on corporate bond rating.

The amounts pooled by applicant companies must satisfy revenue- and equity capital-based limits. A company’s underlying assets may not be pooled in excess of one sixth to one half of revenues and three times equity capital.

Pooling Cost

Unlike loan guarantees, P-CBO guarantees incur no guarantee fee. SMEs bear a portion of the risk until maturity by acquiring junior bonds at an annual rate of 0.1% ∼ 1.8%. A fixed interest rate assessed differentially according to credit rating applies to fund borrowing, and interest is paid every three months following the issuance of asset-backed securities.

Comparison with General Guarantees

The P-CBO guarantee is a direct financing method using capital markets. SMEs and middle-standing companies of a designated size are eligible, and the guarantees have limits higher than that of general guarantees.

| Item | General guarantee | P-CBO guarantee |

|---|---|---|

| Guarantee limit |

|

|

| Procurement method |

|

|

| Guarantee fee |

|

|

| Interest rates |

|

|

| Maturity |

|

|