Credit Insurance

Overview

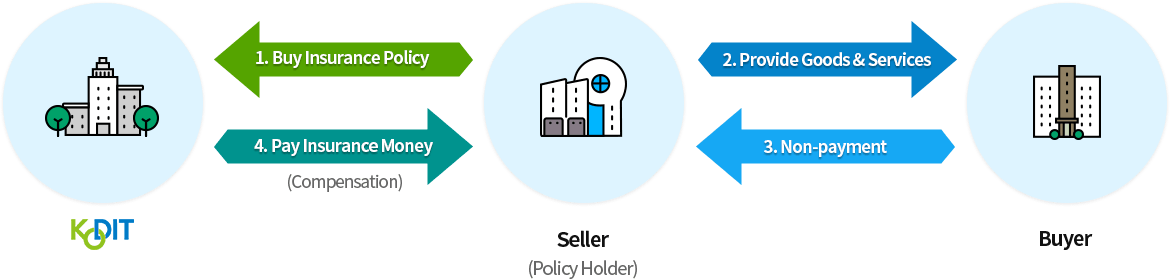

Credit insurance is a business that, in the occasional case that creditors (sellers) providing goods or services on credit in B2B transactions are unable to receive payment due to debtors’ (buyers) insolvency or default, KODIT pays insurance money to the creditors for such losses.

The Asian financial crisis provoked a series of SME bankruptcies caused by promisors going belly up. KODIT adopted corporate bill insurance in 1997 to prevent serial bankruptcies of SMEs and promote credit transactions among companies.

Companies suffering from management crises due to serial bankruptcies thereafter reduced their use of corporate bills in payments, and payment methods to use instead of such bills were introduced. In 2004, KODIT launched accounts receivable insurance to cover accounts receivable from commercial transactions on credit. This insurance type now accounts for most of KODIT’s credit insurance activity.

- Seller(Policy Holder) → 1. Buy Insurance Policy → KODIT

- Seller(Policy Holder) → 2. Provide Goods & Services → Buyer

- Buyer → 3. Non-payment → Seller(Policy Holder)

- KODIT → 4. Pay Insurance Money(Compensation) → Seller(Policy Holder)

Operation

Accounts receivable insurance

KODIT’s accounts receivable insurance seeks to cover unforeseen losses suffered by the insured due to insolvency or default by a buyer on accounts receivable from the supply of goods or services by the insured to the buyer during the insured term.

Insurance Eligibility and Policy limits

SMEs and middle-standing companies may take out an insurance policy for accounts receivable, with the exception of companies in select sectors with low need for insurance. Companies whose buyers are the central government, public institutions, or companies overseas and those with low credit ratings are ineligible.

The policy limit for an insured company is KRW 10 billion. The individual policy limit depends on the credit rating, transaction size, and sector of the insured.

Insurance Premium

Insurance premiums are assessed at an annual rate of 0.1%-5.0% based on the credit rating of the buyer, companies that are the target of insurance, the percentage of the insured’s business accounted for by such buyer, and the payment deadline. The premium is assessed by multiplying the amount of the account receivable subject to the policy by the premium rate and the ratio acquired by KODIT.

Scope of Coverage

If an insurance incident such as insolvency or default by the buyer occurs, KODIT pays to the insured either the amount insured by the buyer or that of damages multiplied by a coverage rate of 70% - 80%, whichever is less.

Commercial Bill Insurance

KODIT’s commercial bill insurance covers such bills received by the insured in return for providing goods or services, and claims are paid out in cases in which such bills are dishonored.